- Ethereum bulls are looking forward to take hold of the price as seen from the weekly chart

Ethereum (ETH) is the second largest coin in the blockchain market which has been in the news for Ethereum 2.0 expected to be rolled out during the first quarter of January 2020. This release would help increase applications being made on the network along with increasing the already large user network.

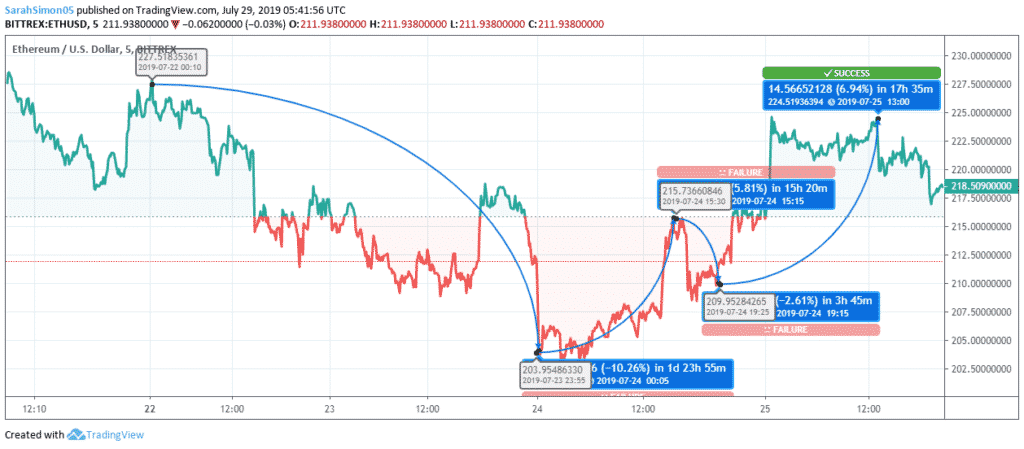

The price of Ethereum, however, has been playing a hide and seek game with the bears winning most of the time during July. The last week had been pretty bearish for Ethereum as seen from the weekly chart where the price has been oscillating in the range of $ 203 – $ 227.

Latest Statistics of ETH/USD

As on July 29, 2019 at 5:42:01 UTC, current statistics is as below:

- Current market price of ETH is $ 218.509

- Current rank is 2

- Current market cap is around $ 22,779,383,465

- 24 h volume is at $ 5,776,090,260

- ROI is still at a grand 7,411.68 %

- Circulating supply is at 107,095,120 ETH

The price of ETH has been trying hard to regain its lost position with the price trying to push itself in the upward range for the past week though the bears had an upper hand. On July 22, the price was $ 227.518. On July 24 in a matter of 1d 23h 55m, the price fell to 203.955 to the extent of 10.26%. On the same day, the price did recover to the extent of 5.81% at $ 215.737 but within 3h 45m the price fell to $ 209.953 to the extent of 2.61%. On July 25, the price rose to $ 224.519 in a matter of 17h 35m, upward movement to the tune of 6.94%. The price today has fallen to $ 218.509, fall being to the extent of 2.68%. The bulls are making their moves in Ethereum but the bears showing a stronger position, bulls are still not being able to consolidate their position.

Ethereum Price Prediction

Ethereum bulls are all set to re-enter the market space though bears are still going strong. The past week was not so good for Ethereum. Analysts feel that Ethereum with its strong fundamentals should be able to pull itself out of the short-term bear trend and expect the price to reach a good target of around $ 500 by the year end.

Long term investors should not worry much about the current bear market trend and invest accordingly. Short-term and intraday investors can also gain if they keep a continuous track of price fluctuations.

Leave a Reply